Wroclaw / Poland 1/31/2022

Experts are convinced that …

This is probably how I would begin this article if it weren’t for the crisis of confidence in media professionals. Such “experts” as Dr. Fauci and a few others are prime examples of media abuse of our trust in people who have close, often hidden, ties to BigPharma.

So I will not quote experts. If only because the subject of this article is the economic crisis, i.e. the actual cause or the decisive factor in the outbreak of the plandemic.

I am not an expert, neither medically nor economically. In the last year of my studies I had one semester of economics – then there was a split between the economics of socialism and capitalism. So I only have a basic idea of what economics is.

I have already been confronted with the objection: If I am not a doctor, what right do I have to speak about medical topics? By this logic, no one is allowed to talk about the weather unless they are trained in meteorology. Despite the dwindling trust in experts, I often use their opinions when those opinions do not contradict basic principles of logical reasoning.

But let’s get to the subject of the economic crisis. A few days ago, an article was published: A Nomura Document May Shed Light on the Repo Blowup and Fed Bailout of the Gang of Six in 2019.

For those who don’t know what the Fed is, I will explain – it is the US Federal Reserve System – a PRIVATE organization established in 1913.

There are numerous reasons that members of Congress, bank regulators, and mainstream media don’t want to talk about the repo blowup in 2019 and the massive Fed bailout that followed. Economist Michael Hudson previously explained how the Fed lacked authority to bail out a handful of trading houses on Wall Street under the dictates of the Dodd-Frank financial reform legislation. Dodd-Frank restricted the Fed to using its emergency lending powers to rescue a “broad base” of the U.S. financial system.

As we detailed on Monday, there was no “broad base” of the U.S. financial system being bailed out by the Fed in the last quarter of 2019: 62 percent of a cumulative $19.87 trillion in rolled-over repo loans went to just six trading houses: Nomura Securities International ($3.7 trillion); J.P. Morgan Securities ($2.59 trillion); Goldman Sachs ($1.67 trillion); Barclays Capital ($1.48 trillion); Citigroup Global Markets ($1.43 trillion); and Deutsche Bank Securities ($1.39 trillion).

Since the US uses a trillion instead of the word billion – which is even more confusing and makes economic matters difficult to understand – let me explain that in both cases (our billion or the US trillion) it’s 1 and twelve zeros. Amount in US dollars. In other words, a million million.

Nomura in Japan; Barclays in Großbritannien; Die Deutsche Bank in Deutschland sind die drei größten Auslandsbanken (aus US-Sicht).

All six of the Wall Street trading houses listed above have one thing in common: large derivative exposure. Consider the revelations in the Consolidated Statement of Financial Condition for Nomura Securities International for the period ending March 31, 2019. (As indicated above, Nomura Securities International received the largest cumulative total of repo loans from the Fed in the fourth quarter of 2019.)

I’m not going to go into the subject here and explain what derivatives are. I’d rather point out that the Fed created massive amounts of US dollars out of thin air. Not in the form of banknotes, but in virtual form – by clicking the appropriate button in the appropriate program on a specific computer. From the moment US President Richard Nixon unpegged the US dollar from gold in 1971, such FED operations became possible.

You don’t need to be an expert to understand that printing a massive amount of money to throw into the market while the economy is being stifled by lockdowns must ultimately lead to massive inflation. The Fed faces a dilemma: raise interest rates, which will bankrupt most of the companies (and countries) indebted to the open market, or continue to add empty money to at least slightly delay the global monetary crisis. The proverbial choice between plague and cholera. The first solution – higher interest rates lead to an economic crisis, the second – to accelerate the depreciation of money – that is, inflation.

This problem is not limited to US dollars. The euro, the British pound, the Japanese yen, the Polish zloty and even the Swiss franc – all currencies are doomed to imminent decline due to losses of up to 90%. I gave the latter 90% out of thin air – it could well be 99%. This is due to the basic principles of economics. So why do we have inflation below 10%? Because that’s how every crisis begins. Real estate and stock prices in many companies have reached levels many times higher than they really are.

The value of money that is not based on a physical value like gold represents trust in that currency. As long as we are willing to accept money for goods and services, money has value. When money loses our trust, it’s worth less than the paper the banknotes are printed on – including the virtual ones in our bank accounts.

Why don’t precious metal prices fluctuate wildly despite inflation? Because these prices are manipulated. In order to keep the price of gold at a lower level, it is enough to throw a fair amount of gold into the market. Also, gold is not the best target for speculators. Precious metals are bought by those who want to hedge against inflation – not to make money. Even if the price of gold should rise sharply in the future – which will certainly happen – this does not mean that the value of gold will increase. It just means a fall in the value of the money that gold is valued at.

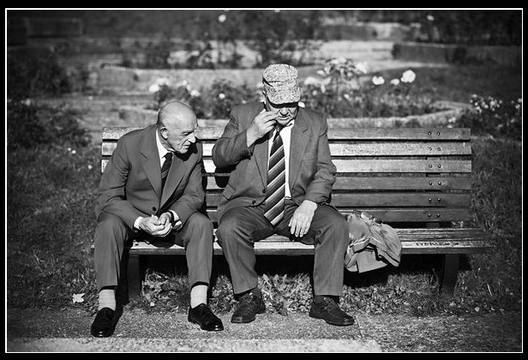

Listen, this crisis is worse than a divorce! I lost half my fortune and I still have my wife!

Author of the article: Marek Wojcik