01/25/2026

Entire blog as a free PDF eBook.

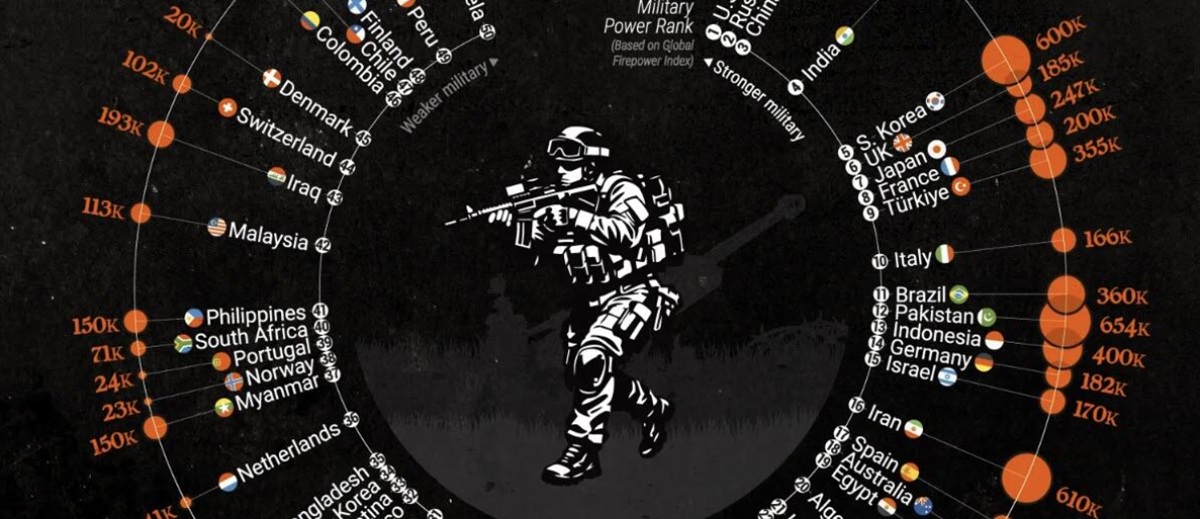

An article appeared on ZeroHedge today: Visualizing The World’s 50 Most Powerful Militaries.

The United States ranks first, with the lowest Military Power Index score and more than 1.3 million active-duty personnel. Its position reflects unmatched global reach, advanced technology, and extensive logistical capabilities. Russia and China follow closely behind. China stands out for having the largest active military manpower among the top three, with just over 2 million personnel, while Russia combines large troop numbers with extensive land and strategic capabilities.

That comes as no surprise. What will be interesting is the answer to the question of which power will continue to prove powerful when the world recovers from the impending, inevitable greatest financial crisis in human history. It is not the pandemic, but precisely this impending catastrophe that represents an opportunity to reflect, reimagine, and reset our world.

The Great Reset is fast approaching, and globalists are far from euphoric about it. Someone has stolen their idea of geopolitical change in the world. Perhaps not so much the idea itself, because these changes were predictable long ago. Globalists have lost their influence on shaping the world that will emerge after the reset of the current way of governing humanity.

It is not military power but money that rules the world. China, with its army of over two million, has no intention of using it. It uses more sophisticated methods to achieve world domination. Who do you think is responsible for the price of silver tripling within a year? The price of gold is also approaching $5,000 per ounce and will certainly exceed this value in the coming days. It is not precious metals that have miraculously increased in value. It is the value of the US dollar, in which the price of these precious metals is quoted, that has finally begun to approach the actual value of this currency.

Where are these changes coming from? There is only one answer: buyers have appeared on the precious metals market who are willing to purchase large quantities. Such large movements on the stock market are not caused by private investors – they are the work of central banks, especially those in Beijing. If you are sitting on worthless US government bonds, you can convert them into cash and buy gold or silver, and that is exactly what they are doing. Japan is in a similar situation.

Not all at once, because such a large amount—and we’re talking trillions of dollars here—cannot be sold on the stock market within an hour. A much better idea is a daily transaction that leads to a gradual decline in the value of the dollar. Why is that? Because you won’t find anyone stupid enough to buy American funds (bonds) today. The only institution that has to accept these (worthless) securities is the US Federal Reserve (Fed). And where does the Fed get the money for this? It usually prints the corresponding amount of dollars in virtual form. Now that there are more dollars, their value must fall, and with it, US debt.

You don’t need to have studied economics to understand the relationships described above. It is the banking experts who constantly invent new “technical terms” to prevent us, the inhabitants of this planet, from understanding these essentially simple mechanisms. Busy with the daily rat race, i.e., the struggle for money to pay our bills, we have no time to think about the forces that compel us to participate in this race.

A man walking through the forest came across some lumberjacks struggling with a blunt saw on a large tree. When he offered to sharpen their tool, they replied: We don’t have time for that – we have to meet our daily quota! Don’t disturb us while we’re working! That is exactly how most of us feel about money.

Who will really pay for it? We will, of course! Inflation is the worst form of taxation. That’s why I have no hesitation in saying that Trump will Make America Poor Again.

Author of the article: Marek Wojcik

Email: worldscam3@gmail.com

<If you like what I write, it would help a lot to further spread these articles if you share them with your friends on social media.